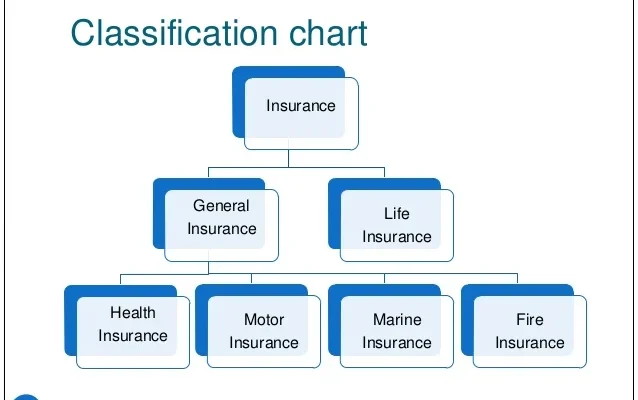

Classification According to the insurance subject

-

- Property insurance is insurance with various material properties as the subject of insurance. The insurer is liable for the loss of material property or material property interests.

- Fire insurance covers property stored on land within a certain geographical range and basically in a stationary state, such as machines, buildings, various raw materials or products, household appliances, etc. for losses caused by fire.

- Marine insurance is essentially a kind of transportation insurance. It is the earliest type of insurance among all types of insurance businesses. The insurer is responsible for the loss of the insured subject caused by maritime dangers.

- Cargo transportation insurance is cargo transportation insurance other than maritime transportation. It mainly covers losses incurred by goods during inland, river, coastal, and air transportation.

- Various means of transportation insurance mainly cover losses incurred during the driving and parking of various means of transportation. The main types of insurance include

- Car insurance covers all types of car body damage and third-party liability.

- Aviation insurance covers the aircraft fuselage, third-party liability, and passenger liability of various passenger aircraft and transport aircraft.

- Ship insurance covers the hulls, onboard machinery, navigation equipment, furniture, materials and supplies, fuel, etc. of all types of maritime vessels (passenger ships, freighters, tankers, container ships, barges, tug barges, yachts, and fishing boats). It can also be insured with Legal liability to be exempted from collision with other ships.

- Rolling stock insurance covers any (including property and liability) damage to a railroad locomotive.

- Engineering insurance covers all accidental losses and third-party personal injury and property damage during various projects.

- Post-disaster benefit loss insurance refers to the insurance in which the insurer assumes insurance liability for various intangible benefit losses that may occur after the property suffers an insured accident.

- Theft insurance covers property damage caused by acts such as robbery or theft by thieves.

- Agricultural insurance mainly covers losses caused by natural disasters or accidents to various crops or cash crops and various livestock and poultry.

- Liability insurance is insurance that takes the insured’s liability for civil damages as the subject of insurance.

- Public liability insurance covers the insured’s legal liability for personal injury or property damage caused by others.

- Employers’ liability insurance covers an employer’s financial liability for an employee’s personal injury or death in accordance with the law or employment contract.

- Product liability insurance covers the insured’s liability for compensation resulting from personal injury or other losses to consumers or users due to defects in the products manufactured or sold.

- Professional liability insurance covers the liability of doctors, lawyers, accountants, designers and other freelancers for personal injury and property damage caused by negligence at work.

- P&I insurance covers the liability for damages borne by a vehicle or boat to others in accordance with the provisions of law or contract while in operation.

- The subject matter of guarantee insurance is credit risk.

- Credit insurance is insurance in which the party entering into a contract requires the insurer to bear the credit risk of the other party to the contract.

- Guarantee insurance takes the obligor as the guaranteed party and requires the insurer to guarantee the performance of obligations to the obligee in accordance with the provisions of the contract.

- Personal insurance is an insurance with a person’s body or life as the subject of insurance. The insurer bears the responsibility of paying insurance premiums when the insured suffers personal casualties during the insurance period, or when the insured is injured or alive at the expiration of the insurance period.

- Personal accident insurance refers to the insurance under which the insurer fulfills its liability to pay insurance premiums when the insured suffers disability or death due to an accident.

- Illness insurance is an insurance in which the insurer pays insurance premiums in accordance with the provisions of the insurance policy to the insured’s medical expenses due to illness or loss of working ability due to illness.

- Life insurance refers to the life or death of the insured person as the insurance subject matter.

- Risk protection life insurance

- Term death insurance is an insurance conditional on the death of the insured during the insurance period.

- Lifetime death insurance is an insurance whose benefits are conditional on the death of the insured person throughout his life.

- Endowment insurance is an insurance that requires the insured to die within the insurance period or survive at the expiration of the insurance period as a condition for payment, and has the nature of savings.

- Annuity insurance takes the insured’s survival as the payment condition and guarantees that the insured will receive payments at certain intervals within a fixed period.

- Investment and financial management life insurance

- participating insurance

- Investment-linked insurance means that the insurance company will not only provide customers with insurance limits with the capital ( premium ) they receive , but also link it to fund targets so that customers can enjoy investment profits.

- Universal life insurance (also known as universal life insurance)

- Risk protection life insurance

- Reinsurance is insurance based on the risks operated by an insurance company .

- Accident life insurance for sole proprietorships. A sole proprietorship is also called a ‘one-person company’. The sole proprietor bears all risks. This insurance includes life accident insurance. If the sole proprietor has any life accident and is unable to continue working, the insurance company will claim up to the total personal income. Eighty percent. This type of insurance is widely used in the Netherlands.

- Property insurance is insurance with various material properties as the subject of insurance. The insurer is liable for the loss of material property or material property interests.